Legacy gifts – gifts left in wills – represent an incredible yet often untapped opportunity for charities. With two primary types of legacy gifts, residuary gifts (a percentage of the remaining estate) and pecuniary gifts (a fixed amount), these contributions can provide transformational income for not-for-profit organisations.

Between 2014 and 2023, legacy donations accounted for a staggering 30.5% of all charity income, despite originating from just 0.07% of total donations.

Data taken from Wood for Trees’ Core Charity Data Model

Great Wealth Transfer

The UK is in the midst of a historic shift in wealth. In the 2020s, an estimated £1 trillion will be passed down from Baby Boomers to their beneficiaries, a figure projected to rise to £5.5 trillion by 2050. This seismic shift, known as the Great Wealth Transfer, presents a significant opportunity for charities to engage supporters about legacy giving.

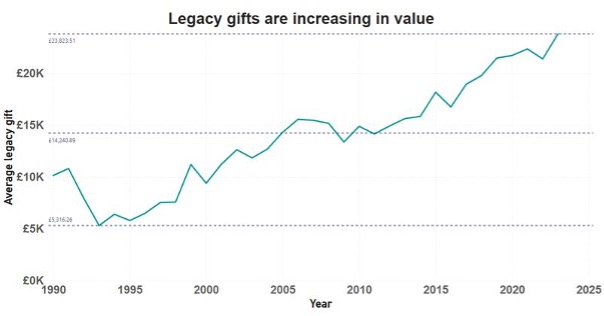

A survey of estate planning organisations highlighted that 65% of beneficiaries could inherit over £200,000 from estates. Legacy giving is not only growing in importance but also in value, with average gifts increasing steadily since the 1990s.

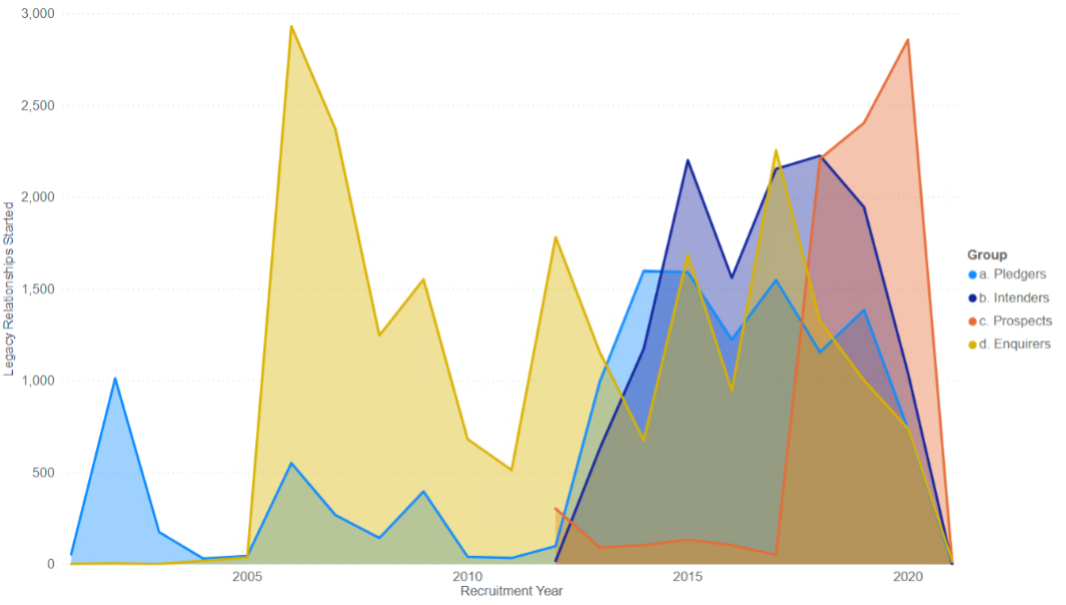

Client case study – In the early process of assessing financial behaviour of legators, we can consider the different stages of legacy relationship and when those relationships started

Why supporter relationships matter

Despite legacies contributing to almost one-third of charity income, only 1.76% of charity supporters leave a gift in their will. However, the data tells us 60.86% of legacy donors had previously donated to the same charity.

This underlines the critical importance of nurturing and maintaining strong supporter relationships across their entire lifecycle. Legacy donors are often loyal supporters with a history of engagement.

Is your charity prepared?

With the Great Wealth Transfer accelerating, now is the time to identify, engage and prepare your future legacy supporters.

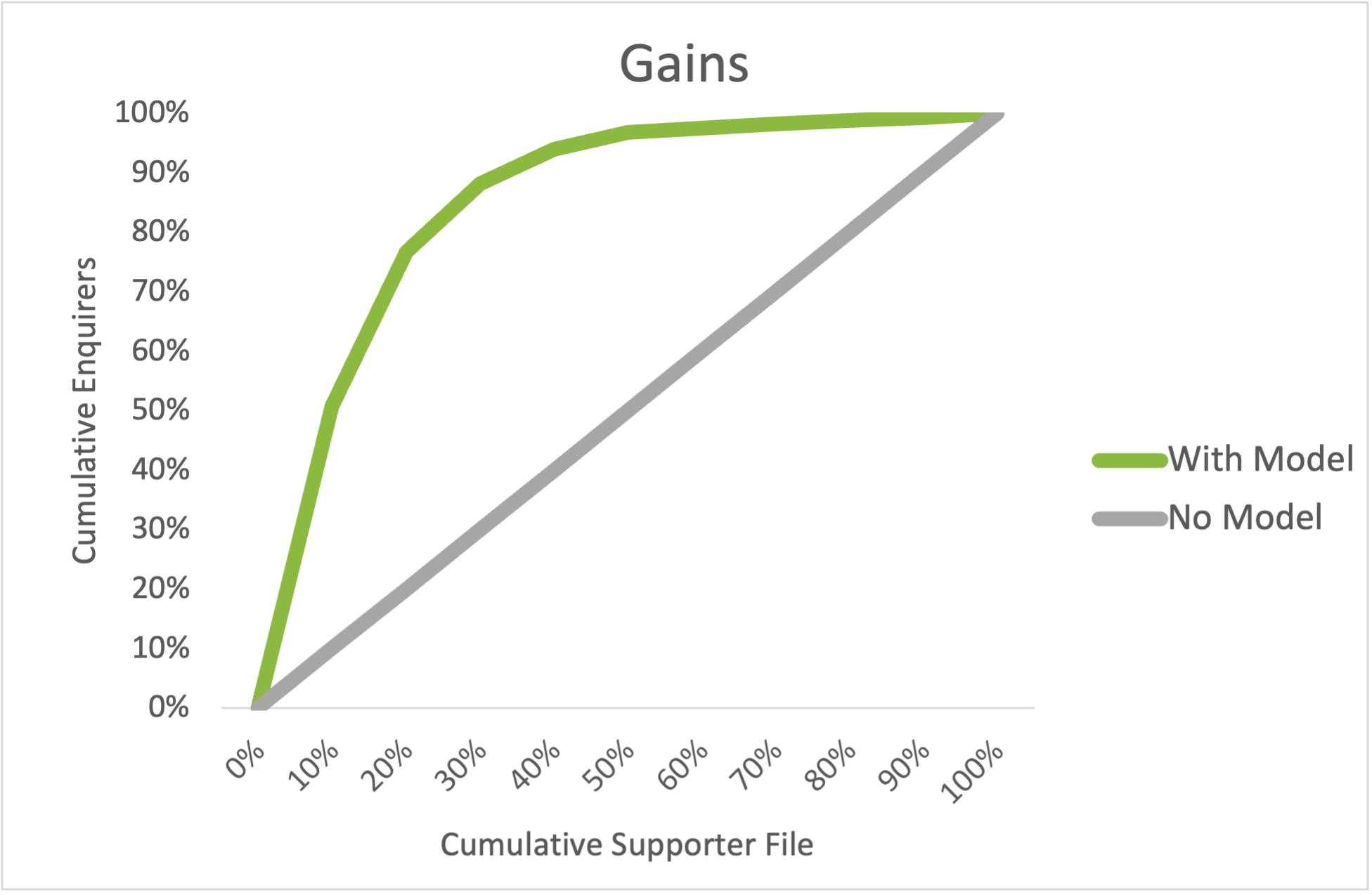

Client case study – Key variables can be used to train a machine learning model which, in this instance, could accurately predict who 90% of legacy enquirers were from just 40% of the overall file volume (the larger the area between the grey and green lines, the greater the predictive and business value the model is adding)

Discover actionable ways to boost your legacy strategy with our free guide. Alternatively, get in touch for an informal chat to see how we can help you unlock the potential of legacy giving.