Your questions answered…

We had some great questions during our state of the sector 2024 webinar. But there were so many we couldn’t get through them all! So, you can find them here, along with the answers courtesy of our consultant analyst, Rob Dyer.

1. What’s the trend in second gift amount/time lapsed for cash donors? Is this declining in reference to time after first gift due to regular giving (RG) take up?

This is slightly tricky to answer, as it’s partly dependent on how soon after a cash gift you ask for a second. Different charities have different approaches, where some won’t make a direct ask for weeks or months after the first gift, others see it as the perfect time to ask again.

Our InsightHub second gift benchmarking report shows the trend line flatten out in the second year after a cash gift, so a lot of second cash gifts are made in the 18 months after the first.

We’ve not previously tracked difference in amount as this can be very specific to a charity’s prompt values, but we’ll look into whether second gifts are higher, lower or the same as the first gift in future reports. Though, again, it’s dependent to some extent on whether the supporters are asked for more, less or the same!

We can’t necessarily say whether this is due to RG uptake. Even if there’s a correlation between those things happening it’s not necessarily cause and effect.

2. Is traditional RG still an opportunity, or should charities be focusing on product-based RG (e.g. lottery, membership)?

Absolutely! Traditional RG is still a product that produces great results for organisations.

It’s a case of best fit for the supporter – some will be interested in more specific things like a membership or sponsoring something, but others will prefer a ‘general funds’ approach where you can divert their donations where you see the most need. The key to a lot of this is trying to offer enough options that your supporter feels empowered to align their affinity with your cause, with a product which they see as tackling the core issue. But, keep in mind, if you try to please everyone you end up pleasing no-one.

You could try gathering information from a cross-section of your supporter base – ask them what makes them tick and how your charity inspires them. Are they receiving content that engages them? Do they think you could do things differently, and would they be interested if you changed your products or approach in future?

Outside the report, what we’re seeing from a donor acquisition perspective is charities offering product-based RG propositions recruiting more successfully and retaining better too, compared to those offering a more traditional direct debit option.

3. Are you still following the ‘single ask, then convert to RG’ journey or seeing more success with straight to RG?

Supporters recruited through RG show a better retention rate in the first year. However, the retention is only marginally different for regular givers from other recruitment products in later years. RG recruits are more likely to make at least one payment, but after the first 12 months there’s little difference in performance.

Most of the campaign analysis we’ve done around acquisition shows that cash recruitment followed by having a robust comms journey for conversion delivers a better overall ROI than a straight RG ask.

4. It’s interesting to see recruitment of supporters in less affluent areas has increased. Is this reflective of a change in media targeting rather than the fact that – in the UK – we know the most affluent regions tend to be the most generous? And do you think there’s a missed opportunity for engaging/stewarding mid-value audiences?

This is likely driven – at least partly – by the channels used to recruit. We’ve seen a fairly sizeable drop in digital and direct response TV (DRTV) recruitment in 2023, whereas face-to-face and direct mail (DM) recruitment has largely remained as it was in 2022.

Face-to-face will depend on how it was carried out – door-to-door would give a good idea of the areas people live in at the point of recruitment, whereas street or other public site recruitment means there’s control over the types of residential locations supporters are brought in from.

The increase in supporters from less affluent areas isn’t necessarily a problem as such, but it potentially means more importance is placed on how supporters are stewarded and the amounts they’re asked to give. It harks back to the standard marketing mantra of ‘right supporter, right channel, right time, right amount.’

5. Do you think the recent boost in legacy income may have come from most of the big conferences (CIOF, Elevate etc.) focusing on this at their events over the past 3-4 years? I’ve noticed there’s much more focus on this now, when pre-pandemic the focus was on challenge events and lotteries.

This is tricky to answer. Anecdotally, I’d postulate that it’s more reflective of changing attitudes in society, post-pandemic.

However, although legacy is on the rise, this isn’t a recent trend. It’s something we’ve been seeing for a while now and some charities have increased their investment in legacy marketing substantially in recent years (read more here).

Additionally, charities across the sector are likely to be stewarding supporters better in general, and using the data they have to make decisions and put appropriate things in front of their supporters, which takes a while to percolate, but ultimately should make those supporters more likely to want to give additional gifts to the charities of their choice.

More useful insights on the recent trends around legacy giving and societal change can be found here.

6. What would you recommend for Gen Z/younger millennials? We know they’re cause and impact driven but not particularly brand loyal. How do we hold on to these ‘butterfly’ donors, or should we look to quick and dirty campaigns to keep acquisition costs low and accept we might struggle to keep them?

As we discussed in the webinar, there’s no single right or wrong solution here. A lot will depend on how your charity currently tries to hold on to supporters from younger age bands.

The point on brand loyalty is an interesting one. If you haven’t already done so, you could try asking a young demographic of your supporters whether they’d be interested in engaging with you in other ways. Perhaps any previous lack of brand loyalty is not your fault or theirs, but is due to not meeting in the middle. With things like increased student loan debt, wage stagnation in an increasingly difficult job market and house prices getting higher and higher, it may not be possible for younger supporters to sustain financial donations to you. But that doesn’t mean they’re not engaged with your cause. If there are other opportunities for them to get involved, then they may surprise you with other impactful engagements.

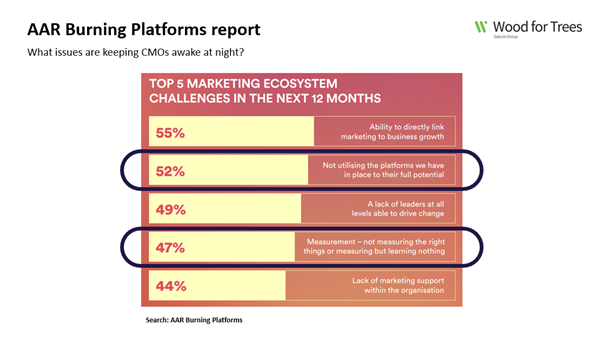

7. Regarding the marketing challenges slide you showed, is this coming from CMOs within charities or the public sector?

This would have been a mixture of both commercial and not-for-profit CMOs.

Source: AAR Burning Platforms Report

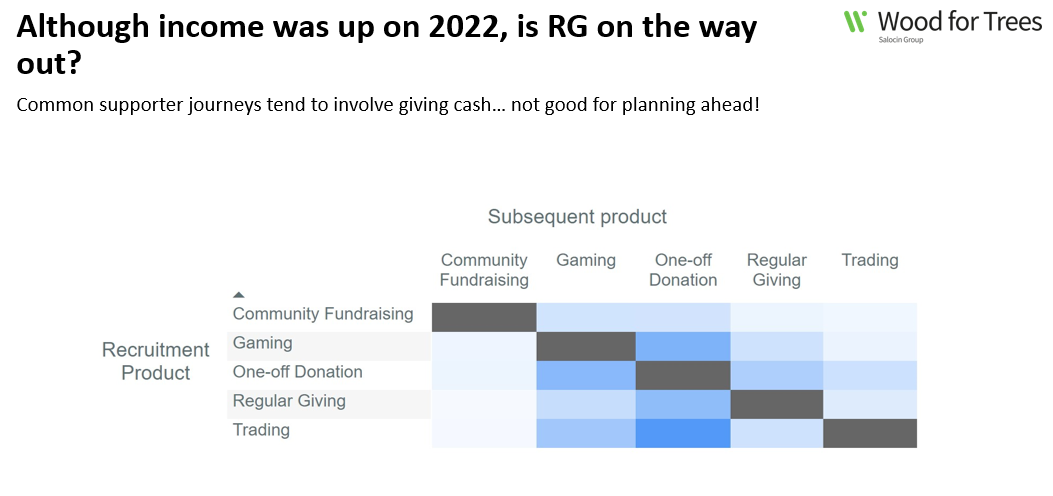

8. What’s ‘trading’ as an action (listed alongside one-off cash, RG, fundraising and gaming)?

Trading in this report is the purchase of physical products, such as a catalogue item, merchandise or shop sales.

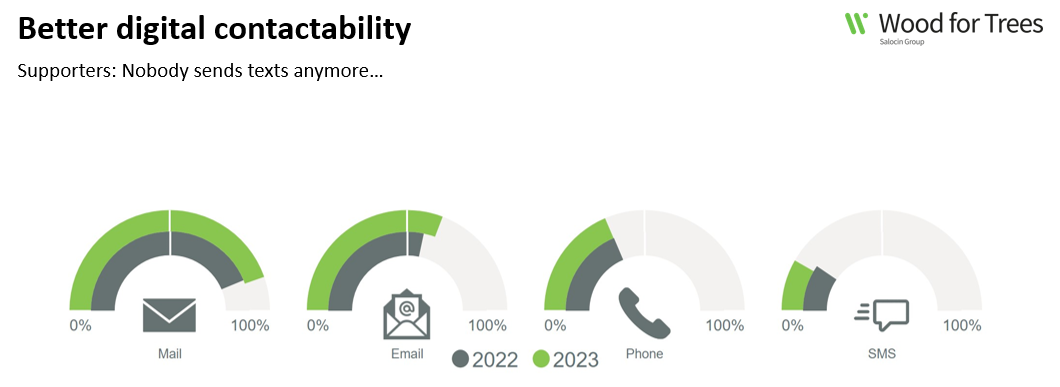

9. Does the declining SMS statistic include WhatsApp and Facebook Messenger?

Not specifically, no. It refers to mobile number capture but in terms of applying permission specifically to use SMS in privacy policies.

Source: InsightHub

10. Interesting that you’re showing recruitment up and average gift down, but from what I’ve been seeing in relation to gaming products, recruitment is down, and average gift is staying high…

The slide presented was an overall view of recruitment and average gifts across products, and there will be differences in there per product and channel. The full version of the report drills into gaming specifically, where we see recruitment is down a little on 2022.

Gaming income has shown stability overall, though a slight downward trend in terms of average gift is also seen.

Source: InsightHub Overall view of recruitment and average gifts across products

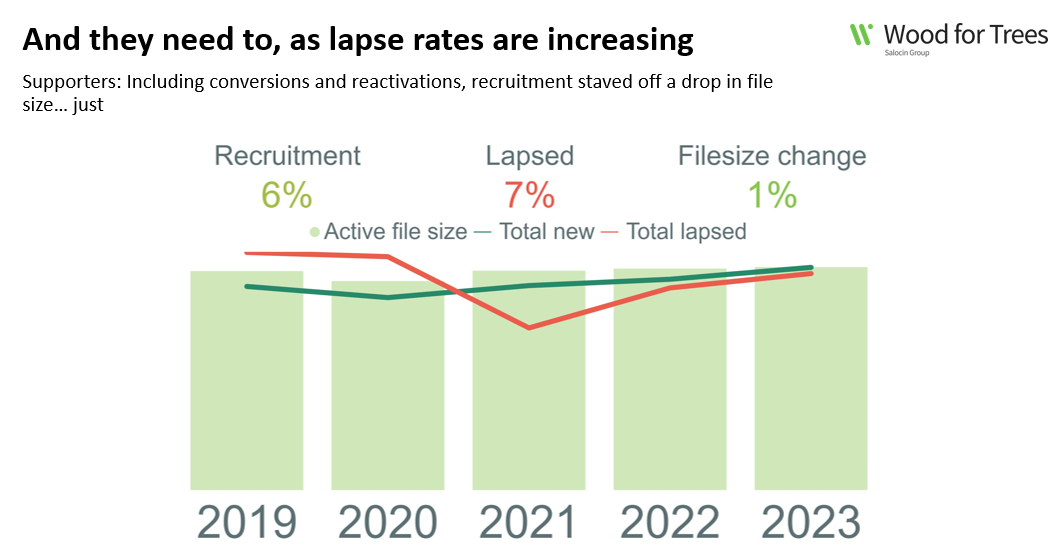

11. I appreciate it’s hard to predict, but is RG likely to keep declining?

It’s very difficult to answer this, as there are so many factors involved. But in a sense RG is always a leaking bucket – eventually it’ll run dry if a tap isn’t turned on to top it up (acquisition of new RG supporters). The question is how often to turn the tap on, how fast to refill the bucket, and how long to leave it on for.

That said, the rate of decline is likely to have increased in recent times due to economic factors outside the charity’s control. In general, things are more expensive than they used to be, and less affordable as wages have tended to not keep up with inflation. So, it’s likely that spending on non-essentials is always likely to be impacted.

However, all is not lost, and there are great things a charity can do to mitigate against this. One thing, referenced by Phoebe Cooper from RSPCA during the webinar, is offering a downgraded RG, rather than lose a supporter altogether. In addition, offering other ways for supporters to be involved can mean they stay involved with the charity in another way. Volunteering their time is a great option or retaining contact details to keep them on lists to help with petitions or other advocacy work. So, even if current regular givers aren’t able to sustain a direct debit, there are great ways of keeping them warm to your cause and more likely to re-engage in future when – hopefully – times are less tough for us all.

12. Can you expand on the journey data slide? I didn’t follow which were the best entry points?

This slide shows the most common journeys supporters have taken. These have involved more one-off donations and less RG. But that’s not to say these common journeys are necessarily better or worse than each other. The journeys will be partly organic where supporters find their own way to what interests them but also driven by the products put in front of them by fundraising teams. One size doesn’t fit all, so working out the right things to offer your supporters will ultimately be the measure of success.

Source: InsightHub Most common journey – all time, main products only

And finally, this question wasn’t asked during the webinar, but let’s conclude with it… What’s the current state of the charity sector?

- The charity sector is in good shape, all things considered.

- Despite increasingly severe challenges, we see green shoots of growth. For income to have increased the way it has since 2021 is remarkable. Recruitment has grown, and while questions remain over the long-term viability of these latest supporters, charities are getting their messages through to new audiences and finding different ways of engaging with them.

- And, while we see challenges ahead with things like retention of supporters, there’s plenty of evidence to suggest the sector is coping fairly well. There are fantastic people in the sector – both working for organisations and supporting them – and it’s these people who ultimately make the difference.

Read about more charity sector trends in our state of the sector 2024 report. Alternatively, watch the webinar replay for the report highlights and expert panel insights.